Setting up GST and HST in IMIS

By Denis Grey on Saturday, February 23rd, 2019

Resources

As a first step, you should review the available information from ASI and the Canada Revenue Agency:

It is particularly important to review the CRA information because you need to know how your specific organization’s taxation should work. Generally speaking, most associations have three types of sales:

- Membership Dues – Membership fees are taxable depending on the kind of membership you offer and your charitable status. In general, if you are a business or professional association then your membership fees may attract GST and HST and the rates will be determined based on the province of residence of your member. If you are unsure of your status, be sure to contact the Canada Revenue Agency to obtain a ruling.

- Events – CRA has specific rules for events and hospitality. Generally, if you are hosting a convention in a specific province then the “service” is delivered in that province and the appropriate GST or HST rules apply there. If you are hosting a “virtual” event that is consumed where the member lives or works then the tax will be based on their province of residence.

- Products / Services – Products and services sold through the Orders module can also attract GST or HST depending on the nature of the product or service. iMIS allows you to determine if a specific product or service attracts GST, HST or both.

Setting up iMIS for Canadian Taxation

System Setup

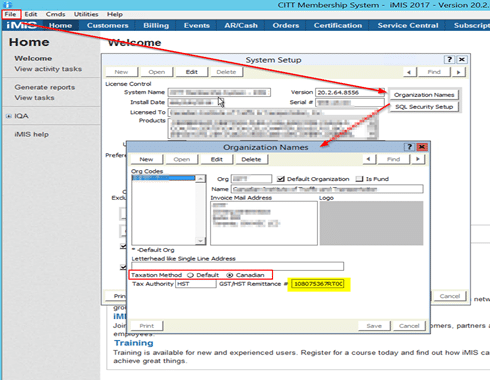

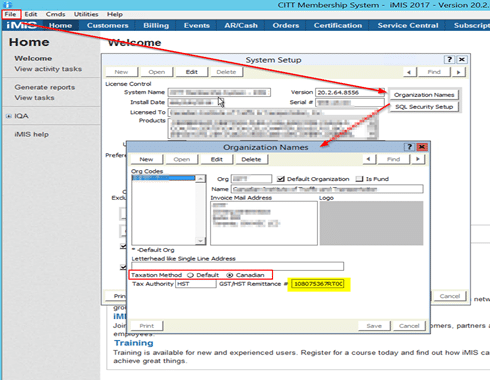

The first step is to turn on Canadian Taxation in iMIS. This is done via the desktop File –> System Setup –> Organization Names. You need to change the Taxation Method to “Canadian” and add your CRA account number.

”

Country Setup

The next step is to enable taxation for Canada. This seems a bit obvious but is essential for the system to work properly. This enables the Orders module to correctly apply GST and HST based on your product settings.

”

Tax Codes

The next area to setup is the individual tax codes. These codes often cause the most trouble for our customers. In order for iMIS to correctly apply the appropriate tax for a given province or territory, you must create a tax code for each province and territory as follows (rates as of January 2019):

Notes:

1. The “G/L Account” should be mapped to your GST or HST liability account and paid out on your CRA remittance schedule. If you are subject to provincial tax, then you may also need to add a provincial rate to your province as well.

2. The Quebec Sales Tax is partially harmonized with the GST in that it applies to the same bundle of goods and services (in other words the tax base is the same). The rate is 9.975% which iMIS can store and handle appropriately.

3. Some clients can use only the generic “GST” and “HST” options, however, you cannot get correct event taxation without adding the provincial codes.

Notes:

1. The “G/L Account” should be mapped to your GST or HST liability account and paid out on your CRA remittance schedule. If you are subject to provincial tax, then you may also need to add a provincial rate to your province as well.

2. The Quebec Sales Tax is partially harmonized with the GST in that it applies to the same bundle of goods and services (in other words the tax base is the same). The rate is 9.975% which iMIS can store and handle appropriately.

3. Some clients can use only the generic “GST” and “HST” options, however, you cannot get correct event taxation without adding the provincial codes.

Membership Fee Taxation

Once you have your basic GST and HST settings correctly configured then you are ready to process Orders and Events in iMIS, however, membership dues are a different matter. Generally speaking, membership dues are not taxable out of the box. This means that you need to setup individual billing codes for:

- Basic Membership Fee

- GST (where applicable)

- HST (where applicable)

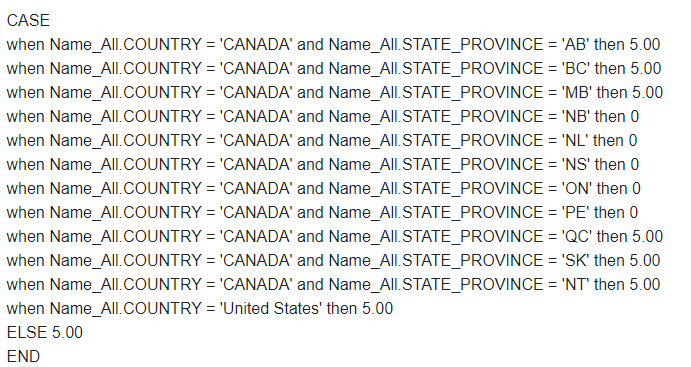

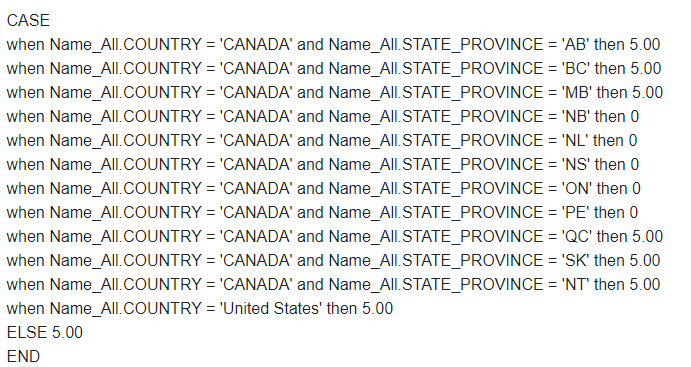

In order to apply the tax correctly, you will need to use special pricing to create the appropriate amounts. Here is an example for a membership fee of $100.00. This charges $5.00 for GST provinces.

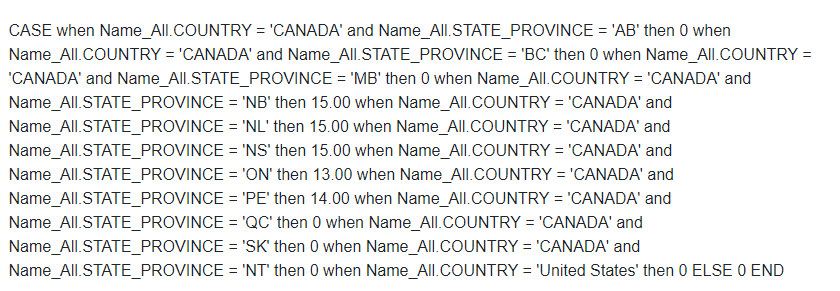

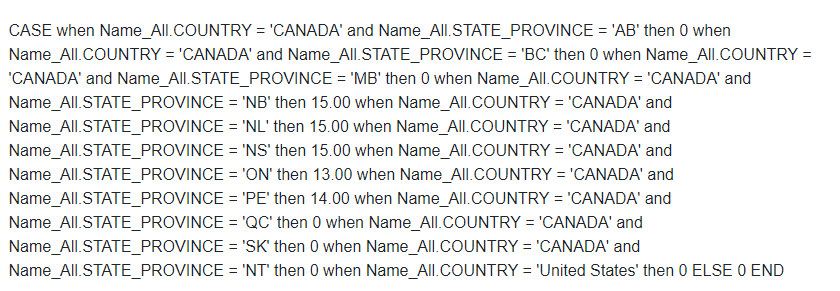

Similarly, we need the inverse of this logic on a separete billing item to charge HST to provinces that participate. Again, the membership fee here is $100.00:

Similarly, we need the inverse of this logic on a separete billing item to charge HST to provinces that participate. Again, the membership fee here is $100.00:

As a final step, you need to set the G/L code to the appropriate GST or HST remittance accounts for these membership fees.

The net result of this is a membership dues billing is that the member will:

1. Have a Base fee of $100.00;

2. Have a GST amount of either $0.00 or $5.00 depending on the province of residence;

3. Have an HST amount of either $0.00, $13.00, $14.00 or $15.00 depending on the province of residence

Because iMIS has a limit of only 10 possible membership fees that can be billed to a specific customer type, you may need to be creative to shoehorn all of your billing codes into the system, however, there is usually a way to get the job done.

As a final step, you need to set the G/L code to the appropriate GST or HST remittance accounts for these membership fees.

The net result of this is a membership dues billing is that the member will:

1. Have a Base fee of $100.00;

2. Have a GST amount of either $0.00 or $5.00 depending on the province of residence;

3. Have an HST amount of either $0.00, $13.00, $14.00 or $15.00 depending on the province of residence

Because iMIS has a limit of only 10 possible membership fees that can be billed to a specific customer type, you may need to be creative to shoehorn all of your billing codes into the system, however, there is usually a way to get the job done.

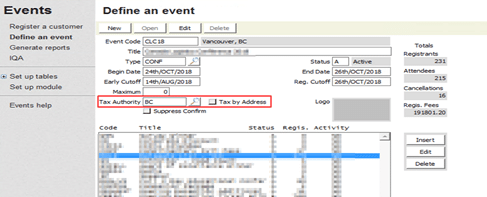

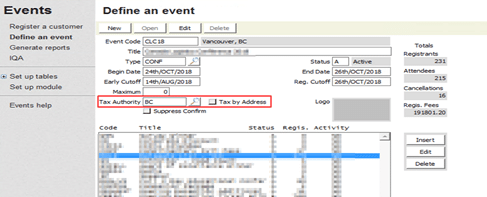

Event Setup

Once your GST and HST is configured, you also need to be mindful of setting up your events to correctly apply the taxes. The key setting is the “Tax Authority” and “Tax by Address” options.

Tax by address causes the appropriate tax to be charged based on the province specified in the registrant’s Preferred Shipping Address. If that is unavailable, iMIS defaults to the tax authority of the event. Registrants see the HST amounts itemized in their carts and receipts. Note that your tax codes must be setup per province for this to be accurate.

General Tips and Tricks

When setting up your taxation, it is essential to:

- Clearly confirm with the Canada Revenue Agency what items/fees are taxable and under what circumstances. If in doubt consult with your public accountant or obtain a ruling from the CRA directly.

- Ensure that you are using the Country field of “Canada” and that the Province codes are setup correctly. Defunct provincial codes such as “PQ”, “ONT” or “NF” should be purged from your database to ensure that everything works properly.

”

”

”

”

Notes:

1. The “G/L Account” should be mapped to your GST or HST liability account and paid out on your CRA remittance schedule. If you are subject to provincial tax, then you may also need to add a provincial rate to your province as well.

2. The Quebec Sales Tax is partially harmonized with the GST in that it applies to the same bundle of goods and services (in other words the tax base is the same). The rate is 9.975% which iMIS can store and handle appropriately.

3. Some clients can use only the generic “GST” and “HST” options, however, you cannot get correct event taxation without adding the provincial codes.

Notes:

1. The “G/L Account” should be mapped to your GST or HST liability account and paid out on your CRA remittance schedule. If you are subject to provincial tax, then you may also need to add a provincial rate to your province as well.

2. The Quebec Sales Tax is partially harmonized with the GST in that it applies to the same bundle of goods and services (in other words the tax base is the same). The rate is 9.975% which iMIS can store and handle appropriately.

3. Some clients can use only the generic “GST” and “HST” options, however, you cannot get correct event taxation without adding the provincial codes.

Similarly, we need the inverse of this logic on a separete billing item to charge HST to provinces that participate. Again, the membership fee here is $100.00:

Similarly, we need the inverse of this logic on a separete billing item to charge HST to provinces that participate. Again, the membership fee here is $100.00:

As a final step, you need to set the G/L code to the appropriate GST or HST remittance accounts for these membership fees.

The net result of this is a membership dues billing is that the member will:

1. Have a Base fee of $100.00;

2. Have a GST amount of either $0.00 or $5.00 depending on the province of residence;

3. Have an HST amount of either $0.00, $13.00, $14.00 or $15.00 depending on the province of residence

Because iMIS has a limit of only 10 possible membership fees that can be billed to a specific customer type, you may need to be creative to shoehorn all of your billing codes into the system, however, there is usually a way to get the job done.

As a final step, you need to set the G/L code to the appropriate GST or HST remittance accounts for these membership fees.

The net result of this is a membership dues billing is that the member will:

1. Have a Base fee of $100.00;

2. Have a GST amount of either $0.00 or $5.00 depending on the province of residence;

3. Have an HST amount of either $0.00, $13.00, $14.00 or $15.00 depending on the province of residence

Because iMIS has a limit of only 10 possible membership fees that can be billed to a specific customer type, you may need to be creative to shoehorn all of your billing codes into the system, however, there is usually a way to get the job done.